The expectations, needs and investments of each customer are different.

IDF offers consulting services to customers with deposits held with credit institutions.

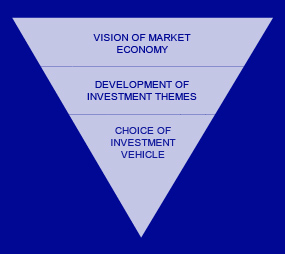

If you wish to earn higher returns on your assets, IDF offers management services and personalised financial solutions that meet your particular needs. Our Private Bankers, who are market experts, will devote to you all the time needed to understand your interests and expectations, suggesting the best strategies for choosing funds, bonds and share indices.

Such choices will generate higher returns than the more traditional Government bonds or repurchase agreements.

IDF operates exclusively with primary private deposit banks and allows to negotiate management fees based on the customer profile.